owe state taxes california

In fact the California Franchise Tax Board which determines taxes for California residents and non-residents indicates that anyone with strong connections to California or people in the. Give Us a Call Today.

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

These Tax Relief Companies Can Help.

. Ad Owe Over 10K in Back Taxes. For instance low-income families may qualify for the Earned Income Tax Credit EITC federally and the California EITC on their state tax return. Our Knowledgeable Professionals Can Answer Your Tax Questions.

End Your IRS Tax Problems - Free Consult. Depending on what you sell you may owe excise tax. There are 43 states that collect state income taxes.

California Franchise Tax Board Certification date. You can also make a payment on the Western Union website or by calling toll-free 800-238-5772. Why do I owe California state taxes this year.

What you may owe. California also ranks fourth for combined income and sales tax rates at 11 with only New York New Jersey. Its tax sits at 133.

You can check the status of your California State tax refund online at the California Franchise Tax Board website. Your household income location filing status and number of personal. It has the highest state income tax rate in the country at 133.

How do I check if I owe California state taxes. Ad Tax Relief Experts Attorneys Work Hand in Hand to Help You Resolve Taxes for Much Less. This can pay anywhere from 255 to 6728.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code. If your income is. Send check or money.

If you apply for a payment plan installment agreement it may take up to 90 days to process your request. Your NSOs have a 4-year vesting schedule with a 12-month cliff and shares vest annually thereafter. You filed tax return.

Ad BBB Accredited A Rating. Tax Help for Owed Taxes 2022 Top Brands Comparison Online Offers. Get Your Qualification Analysis Done Today.

Take Avantage of IRS Fresh Start. In 2021 for example the minimum for single filing status if under age 65 is 12550. Typically you may have up to 3 to 5 years to pay off your balance.

As of July 1 2021 the internet website. Why We Pay State Taxes People who have earnings and enough. The minimum income amount depends on your filing status and age.

On June 2 2019 the FMV is 2 and you exercised the 2500 NSOs that vest. Our income tax calculator calculates your federal state and local taxes based on several key inputs. From gambling to gas-guzzlers keep reading to learn all about the California tax rates and how our team at Community Tax can help you earn the most back on your state tax return.

Apply by phone using the Interactive Voice Response IVR system at 1-800-689-4776 during normal business hours. You will need to know. You received a letter.

Ad Quickly End IRS State Tax Problems. Apply by mail by completing and signing page three of form FTB 3567. This option is not available for business tax payments.

California for instance has the highest state income tax rate in the United States.

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Do I Have To File State Taxes If I Owe Nothing

You Owe Taxes In California What Happens Landmark Tax Group

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

State Error Means Wealthy Minnesotans Owe More Taxes Star Tribune

I Owe California Ca State Taxes And Can T Pay What Do I Do

What Are Marriage Penalties And Bonuses Tax Policy Center

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

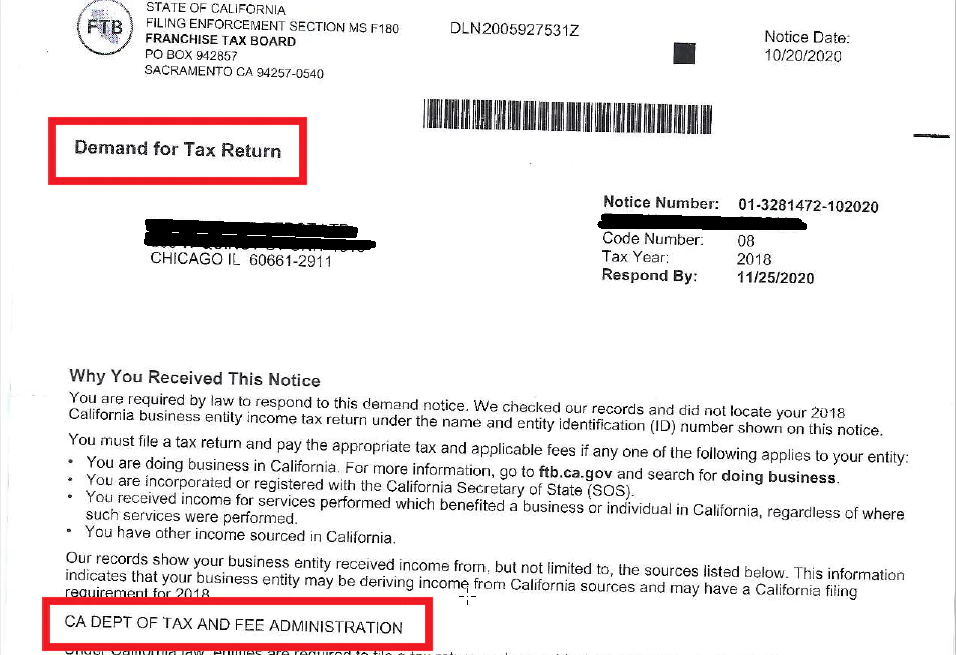

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

Rubyhome Luxury Real Estate Luxury Realtors

Will I Get A Stimulus Check If I Owe Taxes And Other Faqs Bench Accounting

California Use Tax Information

What To Do If You Owe The Irs Back Taxes H R Block

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules